Dubai Tax-Free Shopping 2026: Your Complete Tourist VAT Refund Guide

Dubai has long been a global shopping paradise, attracting millions of visitors who come to explore its luxury malls, designer boutiques, and vibrant souks. Beyond the glamorous stores and exclusive deals, international tourists have the added advantage of tax-free shopping. Through the UAE’s Tourist VAT Refund Scheme, visitors can claim back a portion of the 5% Value Added Tax (VAT) on eligible purchases, making Dubai even more appealing as a retail destination.

Understanding the rules, procedures, and best practices for claiming your VAT refund is crucial to ensure a smooth, profitable shopping experience. This guide will cover everything from eligibility to the step-by-step process, refund methods, exclusions, and practical tips for tourists.

What is Dubai Tax-Free Shopping?

Dubai Tax-Free Shopping refers to the Tourist VAT Refund Scheme, an official program administered by the Federal Tax Authority (FTA) and operated by Planet Tax Free. It allows non-resident tourists to recover most of the VAT paid on qualifying purchases when exporting goods from the UAE.

Why it matters:

- Increases disposable budget for international visitors.

- Encourages tourists to shop at registered retailers, including luxury brands and electronics.

- Enhances Dubai’s position as a leading global shopping destination.

Eligible purchases range from fashion and accessories to electronics and home goods, with refunds provided through multiple convenient channels, including credit cards, cash at airports, and digital wallets.

Who Can Claim VAT Refund?

Eligibility Criteria

To qualify for a VAT refund, tourists must meet the following conditions:

- Non-UAE resident: Only international visitors can claim refunds.

- Age: 18 years or older.

- Goods export: Purchases must be physically carried out of the UAE.

- Purchase limits: Minimum spend of AED 250 per transaction.

- Validation window: Purchases must be validated within 90 days at an airport, land border, or seaport before leaving the country.

Some stores, even in major malls, may not participate in the scheme, so always confirm before purchasing.

What Purchases Qualify?

Eligible items are usually tangible goods bought from registered Planet Tax Free retailers. Examples include:

- Fashion & luxury items: Clothing, handbags, shoes.

- Electronics: Smartphones, laptops, cameras (check store participation).

- Souvenirs & gifts: Perfumes, watches, accessories.

- Home décor & small appliances: Eligible if purchased from registered stores.

Excluded items:

- Consumables like food and beverages.

- Services including hotel stays, restaurants, and spas.

- Vehicles, boats, or aircraft.

- Used or opened items with no original packaging.

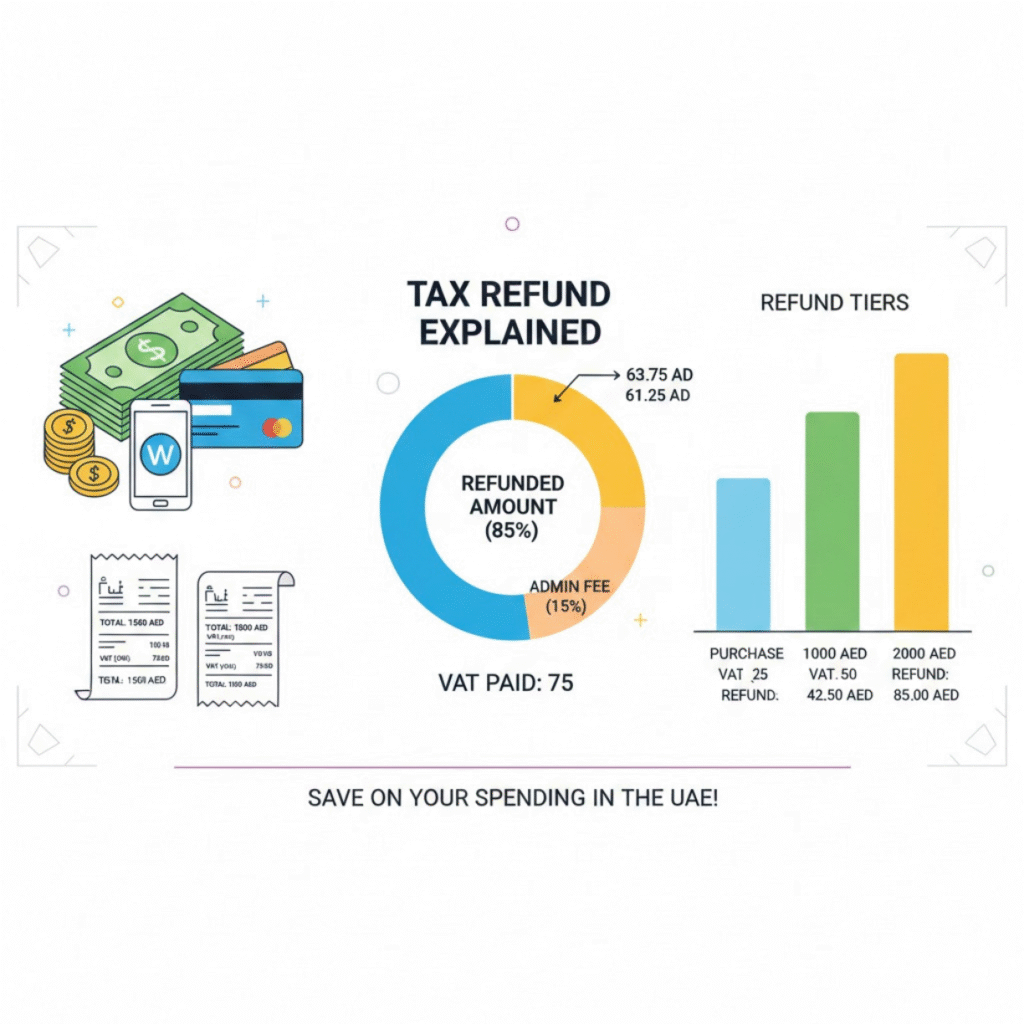

How Much Can You Get Back?

Dubai tourists can claim up to approximately 87% of the 5% VAT paid on eligible purchases after processing fees.

| Purchase Amount | VAT Paid | Refund After Fee (AED 4.80/tag) |

| AED 250 | 12.5 | ~10.8 |

| AED 500 | 25 | ~21.7 |

| AED 1,000 | 50 | ~43.7 |

Refund methods include:

- Credit or debit card (refund in 9–10 business days)

- Cash at airport counters (instant, subject to limits)

- Digital wallets (instant or within hours)

Step-by-Step Tax-Free Shopping Process

Step 1 — Make Eligible Purchases

- Shop at Planet Tax Free registered retailers.

- Spend AED 250 or more per invoice.

- Present passport and travel documents at checkout.

- Obtain a tax-free tag or digital invoice.

Step 2 — Validate Before Departure

- Visit a Planet validation kiosk or counter at Dubai International Airport, Abu Dhabi, Sharjah, or other exit points.

- Scan your passport, boarding pass, and tax-free tag.

- Select your refund method: cash, card, or digital wallet.

Step 3 — Receive Your Refund

- For cash: collected at airport kiosks.

- For card: credited within 9–10 business days.

- For digital wallet: usually processed within hours.

Pro tip: Validate early at the airport to avoid queues, especially during peak tourist seasons.

Cash vs Card vs Digital Wallet

| Refund Method | Speed | Fees | Convenience |

| Cash | Instant | None | Limited to counter limits |

| Card | 9–10 days | AED 4.80/tag | Convenient for post-trip use |

| Digital Wallet | Instant/few hours | AED 4.80/tag | Requires compatible wallet app |

Best Places for Tax-Free Shopping

Although the scheme is available UAE-wide, certain Dubai shopping hubs maximize both selection and convenience:

- The Dubai Mall – Luxury brands, high refund volumes.

- Mall of the Emirates – Wide retail mix, frequent Planet counters.

- City Walk Dubai – Boutique stores and quick validation.

- Dubai Duty Free – Airport shopping with instant VAT refunds.

Tip: Always verify store participation; some brands may opt out of the Planet Tax Free scheme.

Common Mistakes to Avoid

- Purchasing from non-registered stores.

- Failing to validate before departure.

- Leaving goods in checked baggage before validation.

- Assuming services like hotels qualify.

- Ignoring minimum spend per invoice.

Brand-Specific Considerations

Some electronics and luxury retailers, including flagship Apple stores, may not participate fully in tax-free schemes. Always confirm before purchase to avoid disappointment.

Timing and Deadlines

- 90-day validation window: All purchases must be validated within 90 days from the date of purchase.

- 1-year claim window: Refund claims must generally be completed within 12 months.

- Airport peak considerations: Arrive 2–3 hours before departure to allow time for kiosk validation.

Digital Tools and Portals

- Planet Shopper Portal: Track purchases and manage digital tax-free invoices.

- Self-service kiosks: Available at airports for validation.

- Manned counters: Assistance and cash refunds.

- Digital invoice links: Sent via SMS or email for paperless validation.

Voice Search & Common Queries

Tourists often ask:

- How do I claim VAT refund in Dubai?

- Which stores qualify for tax-free shopping?

- Can I combine receipts for refund?

- Do digital invoices work?

- What is the minimum spend for VAT refund?

Optimized content should provide short answers upfront with detailed steps following to satisfy both direct voice queries and deep research needs.

Decision Framework: Should You Shop Tax-Free?

Ask yourself:

- Are you a non-resident tourist?

- Will you take goods out of the UAE within 90 days?

- Is your store Planet Tax Free registered?

- Is your purchase AED 250 or more per invoice?

✅ If yes to all, claiming VAT refund is worth the effort.

Checklist Before Shopping

- Passport and travel documents ready.

- Confirm store registration with Planet Tax Free.

- Ensure purchases meet minimum spend.

- Collect tax-free tag or digital invoice.

- Track purchases via Shopper Portal.

- Validate at airport before departure.

Frequently Asked Questions (FAQs)

Q1: Can I shop tax-free if I live in the UAE?

No. Only non-resident tourists can claim VAT refunds.

Q2: Can online purchases qualify?

Only if purchased from a registered retailer under the Planet scheme.

Q3: How long does validation take at the airport?

It can take a few minutes per invoice; queues may extend time during peak travel.

Q4: Is there a fee to claim VAT refund?

Yes, a fixed AED 4.80 per tax-free tag applies.

Q5: Can someone else validate my refund?

No. Only the purchasing tourist can validate and claim the refund.

Q6: Do hotels or services qualify for tax-free shopping?

No, only physical goods purchased from registered stores.

Q7: What is the minimum purchase for VAT refund?

AED 250 per transaction.

Q8: How is the refund issued?

Through cash, card, or digital wallet based on your selection at validation.

Q9: Can receipts be combined to meet minimum spend?

No, each invoice must individually meet AED 250 minimum.

Conclusion

Dubai’s tax-free shopping program offers a tangible way for tourists to save money while enjoying the city’s world-class retail offerings. By understanding eligibility, following the step-by-step process, choosing the best refund method, and avoiding common pitfalls, visitors can maximize their returns and enjoy a seamless shopping experience. Remember to validate purchases, plan ahead for airport queues, and confirm store participation to make the most of your Dubai shopping adventure.

Muhammad Rehan

SEO Expert with 7+ Years of Experience

With over seven years of experience in Search Engine Optimization, I specialize in enhancing website visibility, driving organic traffic, and boosting online presence for businesses. My expertise spans technical SEO, content optimization, keyword research, link building, and data analytics. I have a proven track record of improving search rankings, enhancing user experience, and delivering measurable results for clients across various industries.