Introduction

If you’re a government employee in the UAE or someone using a Ratibi Card for salary disbursement, knowing how to check your salary details is crucial for financial planning and peace of mind. The Ratibi Card offers a convenient method for accessing your monthly salary, but navigating the process can sometimes be a challenge. In this guide, we’ll walk you through the steps to check your salary, address common issues, and explain why this process matters.

What is the Ratibi Card?

The Ratibi Card is a salary disbursement tool used by employees in the UAE, especially within the public sector. This government-issued card enables employees to receive their salaries digitally, providing an easy and efficient way to access monthly payments. It’s part of the UAE government’s initiative to streamline payroll services and reduce administrative delays.

Why It’s Important to Check Your Ratibi Card Salary

Checking your salary regularly through the Ratibi Card has several benefits:

- Timely Financial Planning: By staying updated on when your salary is credited, you can effectively manage your finances, pay bills on time, and plan for upcoming expenses.

- Verify Accuracy: It’s essential to ensure there are no discrepancies in the salary amount deposited. Sometimes, deductions or errors might occur.

- Avoid Payment Delays: Regular checks help you detect any potential delays or issues with salary processing early, allowing you to take swift action.

How to Check Your Ratibi Card Salary

Checking your salary on the Ratibi Card portal is straightforward. Here’s a simple step-by-step guide to follow:

Step 1: Log In to the Official Ratibi Card Portal

- Visit the official Ratibi Card salary portal (or use the app if available in your region).

- Enter your login credentials (username and password).

- If you’ve forgotten your details, use the “forgot password” feature to reset it.

Step 2: Enter Your Ratibi Card Details

- Once logged in, input your Ratibi Card number or any required personal details to verify your identity.

- Make sure the information is accurate to avoid login issues.

Step 3: View Salary Information

- After logging in and entering the details, navigate to the “Salary History” or “Salary Overview” section.

- Your current and past salary records will be displayed, showing the full breakdown of your salary, including deductions, net pay, and the payment date.

Step 4: Download or Print Your Salary Slip (Optional)

- Most portals offer an option to download or print your salary slip for future reference or reporting purposes.

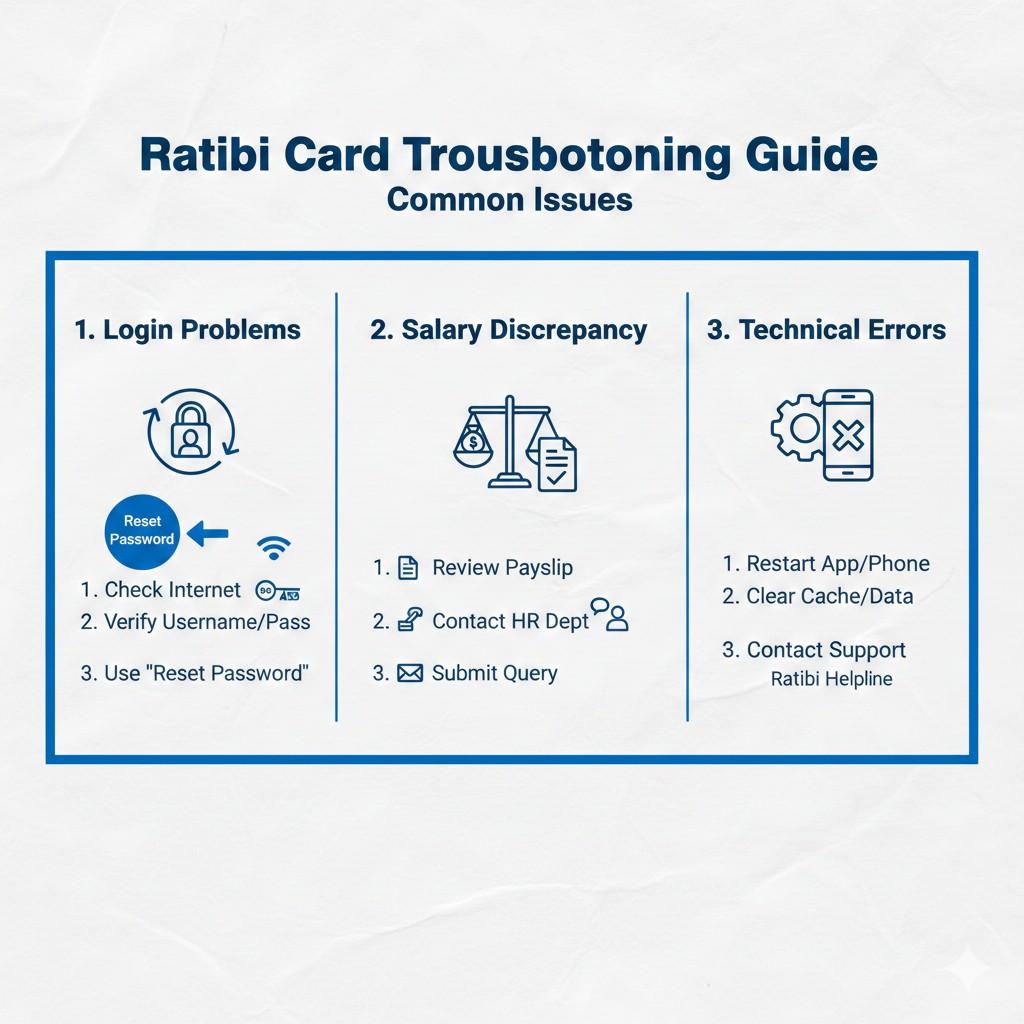

Troubleshooting Common Issues

While the Ratibi Card salary check system is designed to be user-friendly, some common issues can arise. Here’s how to troubleshoot:

Issue 1: Unable to Log In

- Solution: Ensure that your login details are correct. If you’ve forgotten your password, use the recovery option available on the portal.

Issue 2: Salary Not Showing Up

- Solution: Sometimes, salaries may not appear immediately due to system updates. If this happens, check if there’s a scheduled payment delay. You can also contact HR or your employer for confirmation.

Issue 3: Salary Amount is Incorrect

- Solution: If the amount doesn’t match what you were expecting, check for any recent deductions or errors. If everything seems correct but the discrepancy persists, reach out to your HR department for clarification.

Issue 4: System Downtime

- Solution: If the website or portal is down, it might be undergoing maintenance. Try again later or check for updates from the UAE government regarding system availability.

Eligibility for Using the Ratibi Card

Typically, employees who work in the public sector or government-related jobs in the UAE are eligible to receive their salary via the Ratibi Card. Some private sector companies might also offer this service as a convenience for their employees. If you are unsure whether you are eligible, you can check with your HR department or visit the official Ratibi Card website.

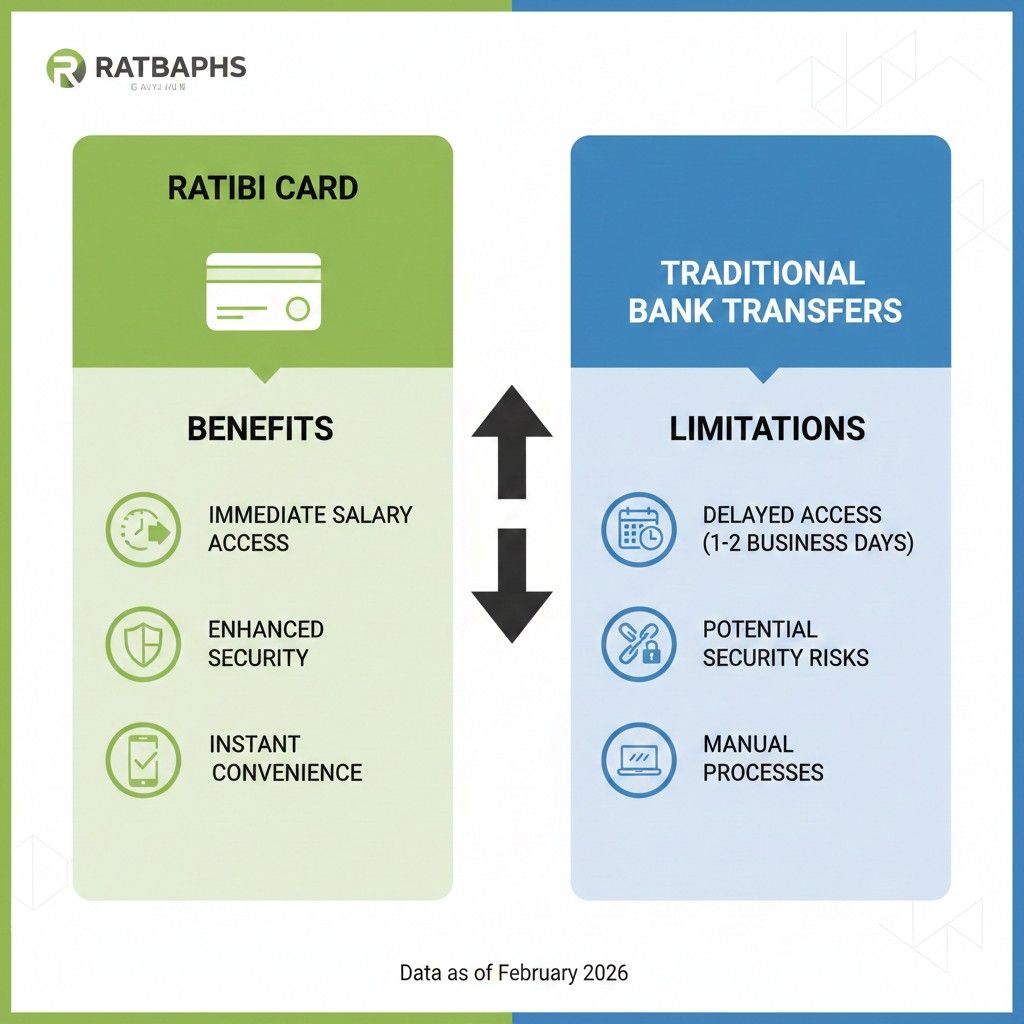

Ratibi Card vs. Traditional Bank Salary Disbursement

Many employees wonder whether the Ratibi Card is a better option than traditional bank salary transfers. Let’s compare:

| Factor | Ratibi Card | Traditional Bank Transfer |

| Speed | Immediate access to salary upon payment date | May take 1-2 business days |

| Convenience | Access via dedicated portal or mobile app | Requires bank visit or mobile banking setup |

| Security | High security with encrypted systems | Varies by bank, may require manual updates |

Ratibi Card offers quicker access to salary and avoids banking delays, making it ideal for those needing fast and easy access to funds.

FAQs About Ratibi Card Salary Check

1. How often can I check my salary on the Ratibi Card?

You can check your salary anytime after it’s credited to your Ratibi Card. Some portals offer real-time updates once the salary is paid.

2. Why is my salary not showing on the Ratibi Card portal?

There could be several reasons, such as system maintenance or delays in processing. Check the portal for any notices, or contact your HR department.

3. What should I do if my salary is lower than expected?

Check for any deductions or errors in the salary breakdown. If discrepancies remain, contact HR or the payroll department for clarification.

4. Can I check previous months’ salaries on the Ratibi Card?

Yes, most portals allow you to view your salary history for previous months.

5. How long does it take for my salary to appear on the Ratibi Card?

Typically, your salary will appear on the Ratibi Card by the end of the scheduled payment date, but it may take longer if there are processing delays.

6. Can I use my Ratibi Card for purchases?

Yes, the Ratibi Card can be used like a standard bank card for purchases, depending on the issuer’s policies.

7. Is there a fee for checking my salary on the Ratibi Card?

There are usually no fees associated with checking your salary. The service is part of the salary disbursement process.

Conclusion

Knowing how to check your salary on the Ratibi Card is a fundamental step for employees in the UAE to manage their finances and avoid any surprises. By following the simple steps outlined in this guide, you can easily access your salary details, troubleshoot any issues, and ensure that everything is in order. Regularly checking your salary ensures that you stay on top of your financial situation and can address discrepancies quickly.

Muhammad Rehan

SEO Expert with 7+ Years of Experience

With over seven years of experience in Search Engine Optimization, I specialize in enhancing website visibility, driving organic traffic, and boosting online presence for businesses. My expertise spans technical SEO, content optimization, keyword research, link building, and data analytics. I have a proven track record of improving search rankings, enhancing user experience, and delivering measurable results for clients across various industries.