Introduction

The Ratibi Card is a powerful prepaid payment solution designed for individuals who need a secure and convenient way to manage their finances, especially those without access to traditional banking. In the UAE, where many people rely on alternative financial services, the Ratibi Card is increasingly becoming a go-to option for receiving government benefits, making purchases, and managing everyday finances. Whether you are a low-income individual or someone seeking a simple financial tool, this card offers a multitude of benefits and features. In this guide, we’ll explore everything you need to know about the Ratibi Card—its features, benefits, application process, and availability in the UAE.

What is the Ratibi Card?

The Ratibi Card is a prepaid payment card that allows users to access financial services without needing a traditional bank account. It is especially useful for people who receive government payments, such as welfare or unemployment benefits, and those who prefer a prepaid solution over opening a bank account. The card can be used for a wide range of transactions, including online purchases, in-store payments, and bill payments, all while offering users the flexibility of controlling their spending.

The card operates on a prepaid system, meaning you can load it with a set amount of money. Once the funds are used up, the card can be reloaded, making it an excellent way to manage spending without worrying about debt or overdrafts.

Why the Ratibi Card Matters

In the UAE, many individuals do not have access to traditional banking services due to various reasons such as low income or geographical barriers. The Ratibi Card provides a solution by offering a secure, easy-to-use financial tool for those who are unbanked or underbanked. Here’s why it’s important:

- Financial Inclusion: The Ratibi Card helps promote financial inclusion by providing access to banking-like services without requiring a bank account.

- Security: It’s a secure way to manage money, as it’s protected by a PIN and cannot be overdrawn.

- Ease of Use: The card can be used for both online and offline purchases, as well as for withdrawing cash from ATMs.

For individuals who rely on government assistance or those without access to financial institutions, the Ratibi Card offers an essential tool to manage their finances securely and efficiently.

Who Should Use the Ratibi Card?

The Ratibi Card is designed for a wide range of users, including:

1. Low-Income Individuals

For those receiving government payments or subsidies, the Ratibi Card provides an easy way to access and manage funds. It eliminates the need for a bank account and offers a safer way to receive and spend money.

2. Students and Young Adults

As students or young adults start managing their own finances, the Ratibi Card provides an entry-level solution to understand money management without the complexities of traditional banking.

3. Freelancers and Small Business Owners

Freelancers and small business owners can use the Ratibi Card to receive payments directly and manage their expenses. It’s a cost-effective and efficient solution for self-employed individuals.

4. Tourists and Expats

For tourists or expats in the UAE, who may not yet have a bank account, the Ratibi Card is a simple way to manage their finances without the need for setting up a full banking relationship.

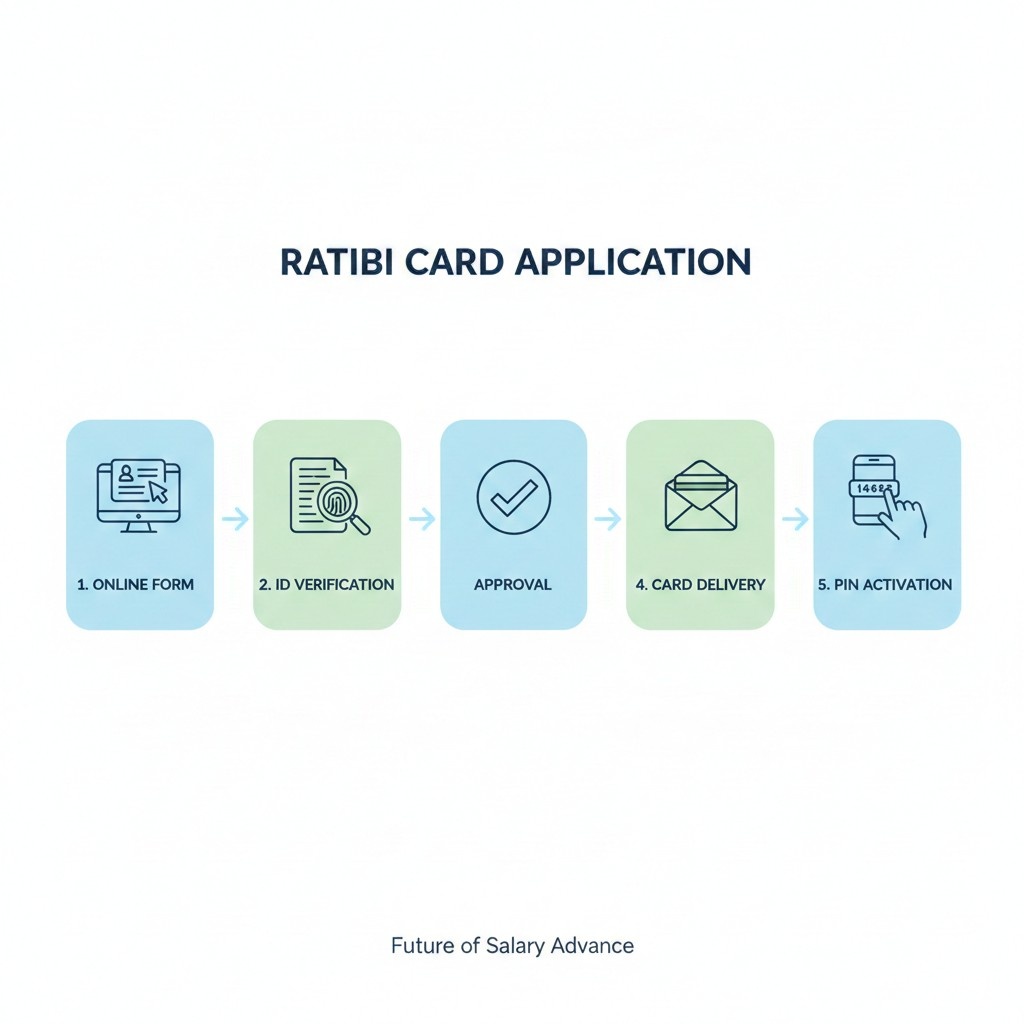

How to Apply for the Ratibi Card in UAE

Applying for the Ratibi Card in the UAE is a simple and straightforward process. Here’s a step-by-step guide to help you get started:

Step 1: Visit the Official Website

Begin by visiting the official Ratibi Card website or visiting a local branch where the card is offered.

Step 2: Provide Your Personal Information

Fill in the required personal details, including your name, address, and proof of identity (e.g., Emirates ID or passport).

Step 3: Submit Verification Documents

Submit the necessary documents to verify your identity. These may include a government-issued ID, proof of income (if applicable), and proof of residence.

Step 4: Wait for Approval

Once your application is reviewed and approved, you will receive your Ratibi Card by mail or in-person, depending on the service provider.

Step 5: Activate Your Card

After receiving your card, follow the activation instructions included in the package. This typically involves setting a PIN for your card.

Key Features and Benefits of the Ratibi Card

1. Secure Transactions

The Ratibi Card is protected by a PIN, ensuring that only the cardholder can access the funds. Additionally, it’s a prepaid card, so you can only spend the balance available on the card, reducing the risk of overspending.

2. Wide Acceptance

The Ratibi Card can be used for both online and offline purchases, making it a versatile option for managing your day-to-day spending. It’s accepted at most retailers, e-commerce websites, and ATMs.

3. No Bank Account Required

One of the primary benefits of the Ratibi Card is that it doesn’t require a traditional bank account. This is ideal for individuals who have trouble accessing banking services or prefer not to use traditional banking.

4. Easy to Reload

The card is easy to reload, either online, through a bank transfer, or at local reloading stations. This flexibility ensures that you can always manage your funds as needed.

5. Cost-Effective

The Ratibi Card is an affordable financial solution. The card itself may have a low activation fee, and there are minimal transaction fees compared to traditional bank accounts.

Local Availability and Pricing of the Ratibi Card

The Ratibi Card is widely available in the UAE, especially in major cities like Dubai, Abu Dhabi, and Sharjah. It is also available through a network of local financial institutions and government-related organizations.

Pricing

The cost of obtaining the Ratibi Card varies depending on the provider. Generally, the card is available for a nominal fee ranging from AED 50 to AED 150, depending on the type of card and additional services offered.

Some providers may also charge small fees for reloading or withdrawing cash from ATMs, so it’s important to check the cardholder agreement for full details on fees.

Comparison: Ratibi Card vs. Traditional Bank Accounts

While the Ratibi Card offers a convenient alternative for managing finances, it’s important to understand how it compares to traditional bank accounts:

| Feature | Ratibi Card | Traditional Bank Account |

| Bank Account Required | No | Yes |

| Monthly Fees | Low or none | May include maintenance fees |

| Security | PIN protection and secure transactions | Bank account security features |

| Transaction Limits | Limited by balance available | Based on account balance and limits |

| Ease of Access | Simple and quick to access | Requires more paperwork and approval |

The Ratibi Card is an excellent option for people who don’t need a full-fledged bank account but still want a secure way to store and spend money.

FAQs About the Ratibi Card

1. What is the Ratibi Card used for?

The Ratibi Card is a prepaid payment card that can be used for online and offline purchases, receiving government payments, and making ATM withdrawals.

2. How do I apply for a Ratibi Card in the UAE?

You can apply for the Ratibi Card by visiting the official website, filling in your details, and submitting verification documents. Once approved, your card will be mailed to you.

3. Can I use the Ratibi Card for online shopping in UAE?

Yes, the Ratibi Card is accepted on most e-commerce platforms in the UAE, making it a convenient option for online shopping.

4. What are the fees for using the Ratibi Card in UAE?

The Ratibi Card has low fees, including an initial activation fee and small fees for reloading or ATM withdrawals. Always check the terms and conditions for specific fee details.

5. Is the Ratibi Card accepted internationally?

Yes, the Ratibi Card is accepted globally, though international transactions may incur additional fees.

6. Where can I get the Ratibi Card near me?

The Ratibi Card is available at local financial institutions and through various government services in the UAE. You can also apply online.

7. Are there any monthly fees associated with the Ratibi Card?

Generally, the Ratibi Card has no monthly fees, but there may be small charges for specific transactions like ATM withdrawals.

Conclusion

The Ratibi Card is a valuable financial tool for individuals in the UAE who seek a simple, secure, and affordable way to manage their money. Whether you’re receiving government assistance, making online purchases, or simply managing your day-to-day spending, the Ratibi Card offers a flexible and accessible solution. With its easy application process, low fees, and wide acceptance, it is an ideal choice for anyone looking to avoid the complexity of traditional banking.

Muhammad Rehan

SEO Expert with 7+ Years of Experience

With over seven years of experience in Search Engine Optimization, I specialize in enhancing website visibility, driving organic traffic, and boosting online presence for businesses. My expertise spans technical SEO, content optimization, keyword research, link building, and data analytics. I have a proven track record of improving search rankings, enhancing user experience, and delivering measurable results for clients across various industries.